See your money work smarter

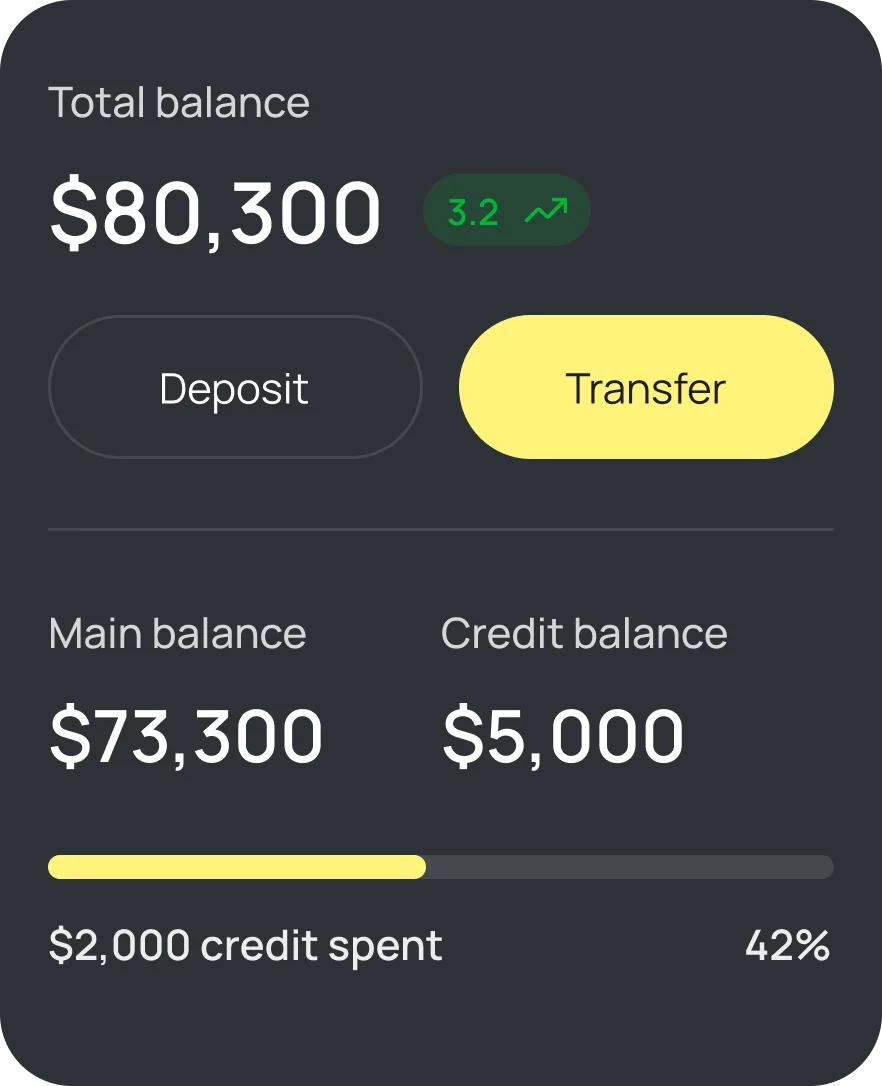

A powerful dashboard that transforms complex financial data into clear, actionable insights. Track savings, monitor spending, and watch your wealth grow in real-time.

Smart Savings Dashboard

Import your bank transactions

Connect to over 15,000 financial institutions worldwide. Import your transactions in a click and start tracking right away.

Secure connection

Bank-level 256-bit encryption keeps your credentials safe and secure.

Automatic sync

Transactions sync every hour automatically, no manual refresh needed.

Smart categorization

AI instantly categorizes your spending into meaningful insights.

15,000+ institutions

Connect to banks, credit unions, and brokerages worldwide.

Real-time updates

See new transactions as they happen, not hours or days later.

Multi-account support

Link unlimited accounts and see your complete financial picture.

AI suggestions

Leverage the power of AI to receive personalised financial suggestions.

Advanced security

State of the art encryption means your data is safe 24/7.

Stella B 3 days ago

Can anyone help me set up a budget?

Community support

Share tips, ask questions, and get support from other users.

Multi-device sync

Sync your data across multiple devices and manage your finances wherever you are.

Debt management

Create a personalized repayment plan and stay motivated as you work towards reducing your debts.

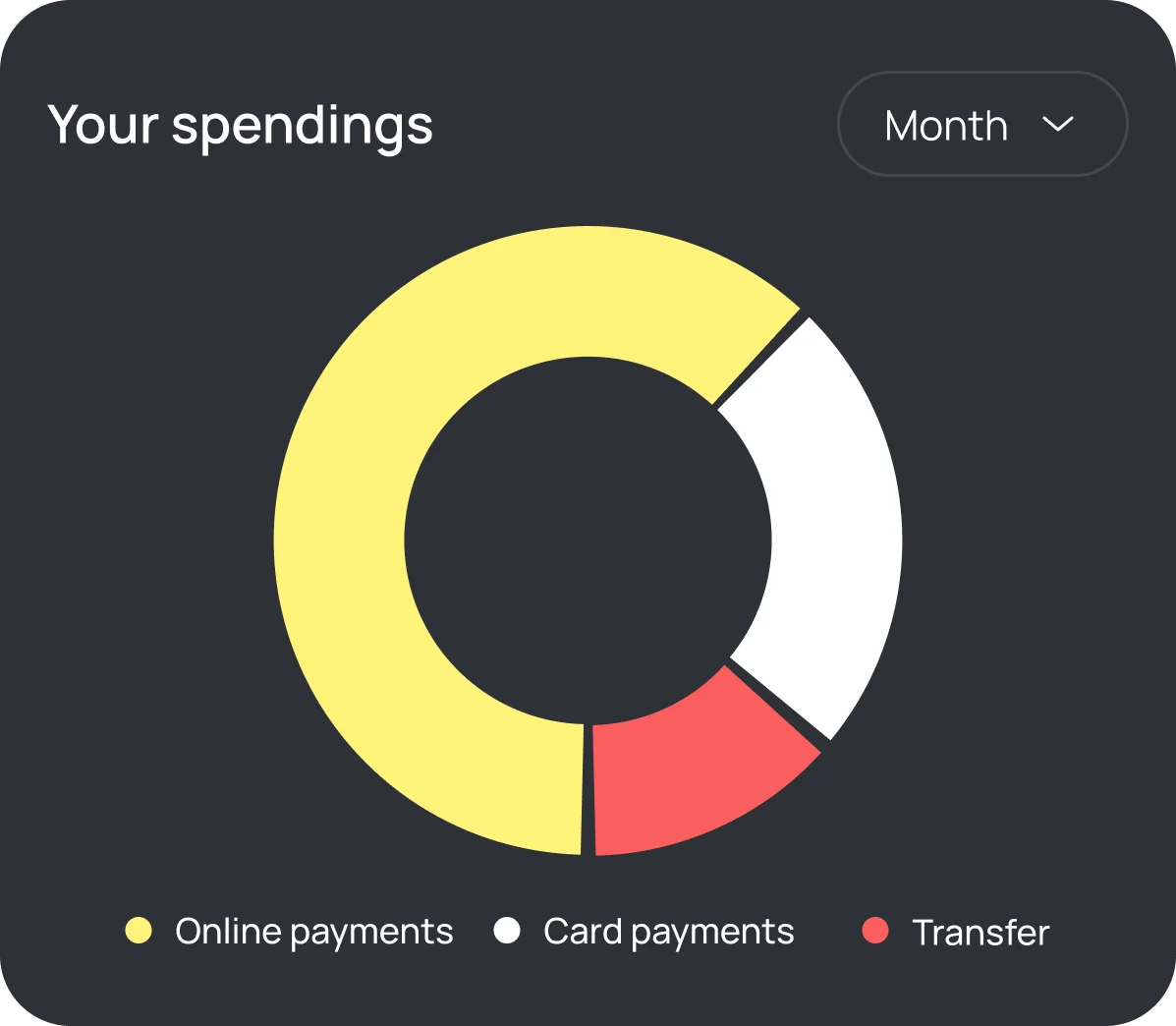

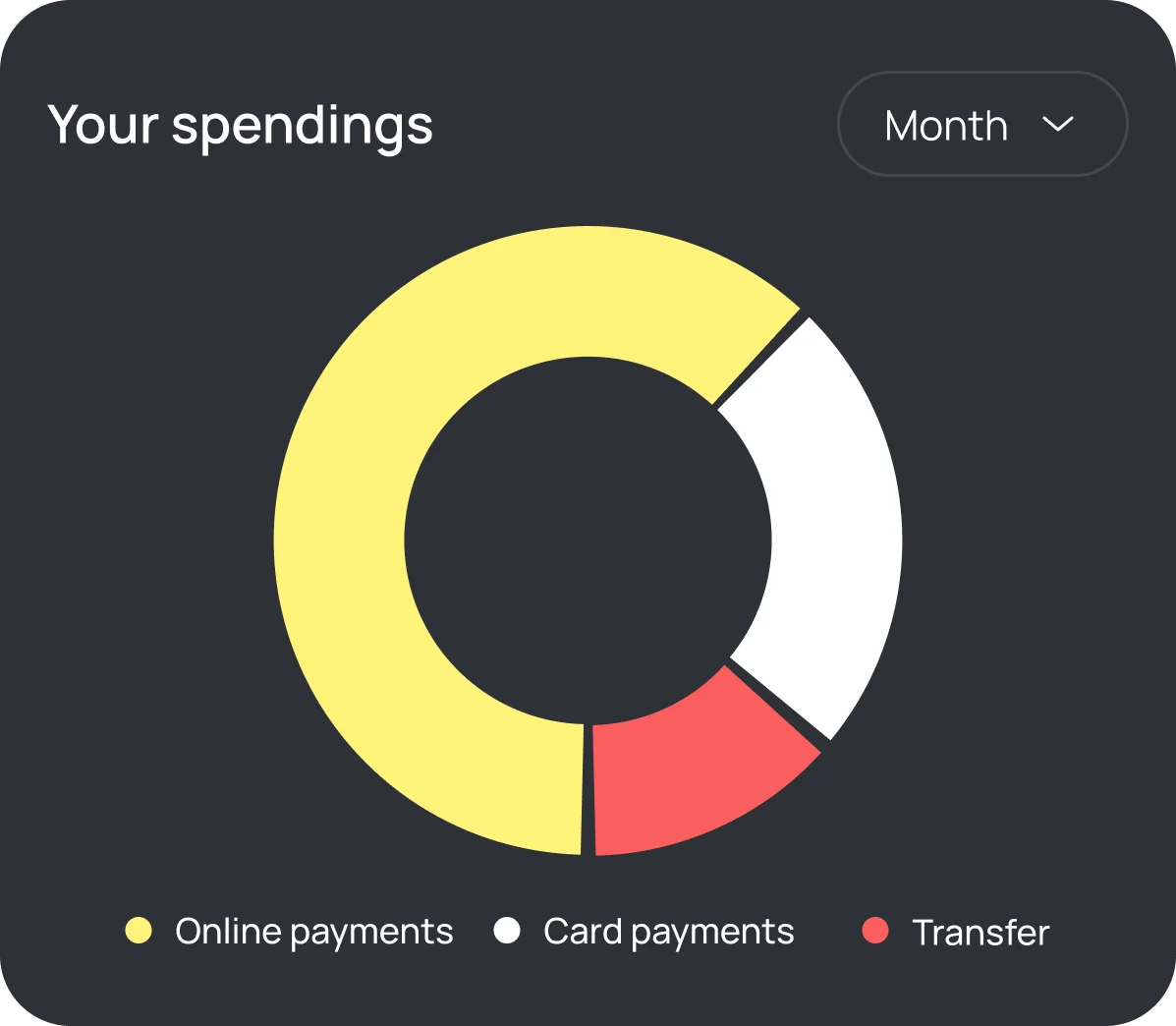

Financial insights

Get a better understanding of your spending habits with a breakdown of your spending habits.

Everything you need to manage your money

Explore the powerful tools designed to give you complete control over your financial life.

AI-Powered Financial Insights

Our machine learning algorithms analyze your spending patterns to uncover hidden opportunities for savings. Get personalized recommendations based on your unique financial behavior.

Receive proactive alerts about unusual spending, upcoming bills, and smart suggestions to optimize your budget automatically.

- Personalized spending analysis

- Smart savings recommendations

- Anomaly detection alerts

- Predictive budgeting

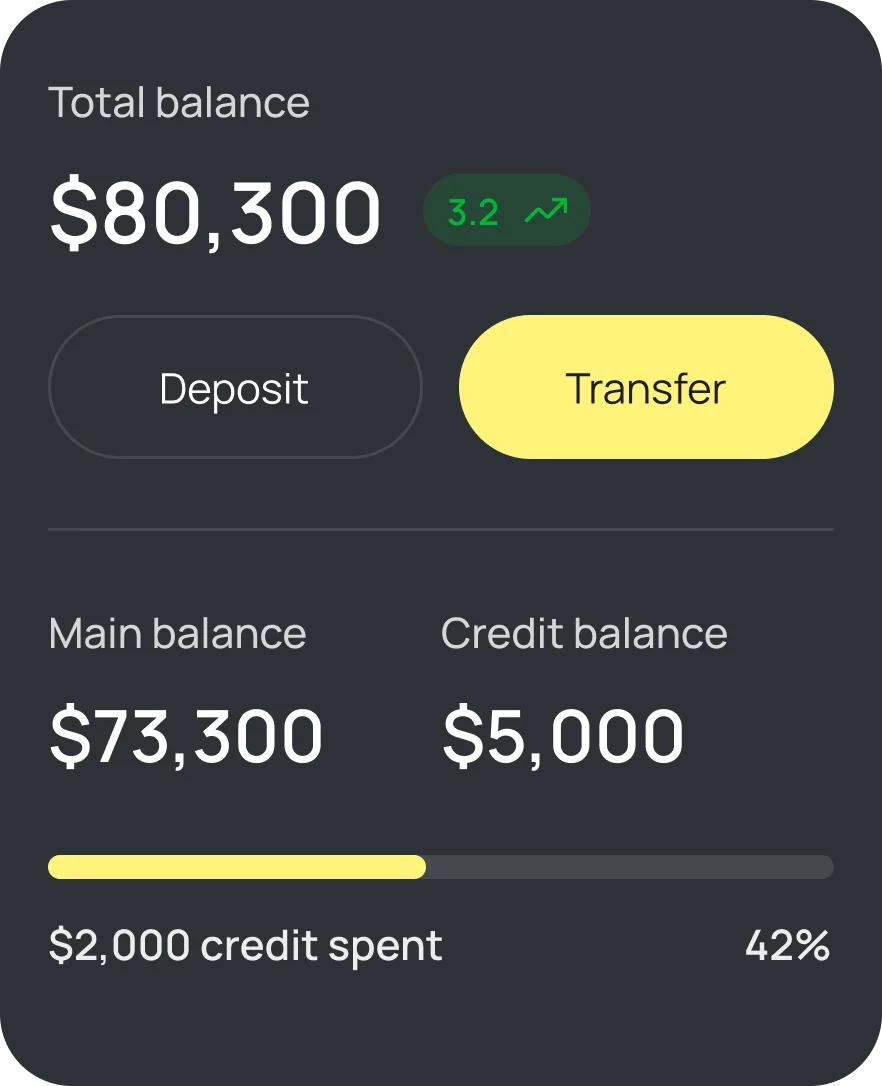

Real-Time Account Sync

Connect unlimited bank accounts, credit cards, and investment accounts in one place. Our secure sync updates hourly so you always have the latest picture of your finances.

Support for over 10,000 financial institutions worldwide with bank-level encryption protecting every connection.

- Unlimited account connections

- Hourly automatic sync

- 10,000+ supported institutions

- Secure bank-level encryption

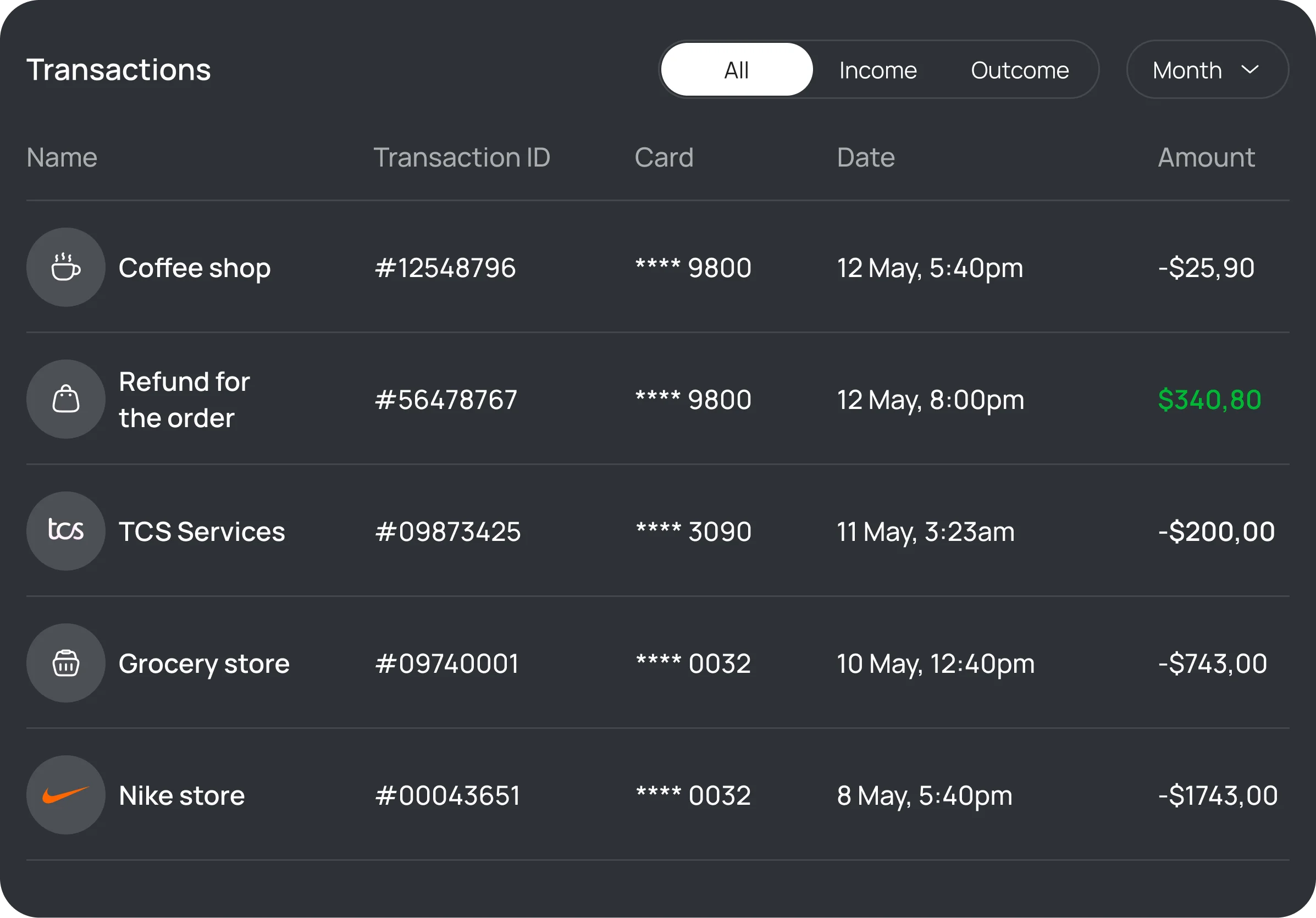

Smart Adaptive Budgeting

Create budgets that adapt to your lifestyle. Our intelligent system learns your spending habits and adjusts categories automatically to keep you on track.

Get proactive alerts before you exceed limits, not after. Stay in control with real-time budget tracking across all your accounts.

- Auto-categorized transactions

- Proactive spending alerts

- Flexible budget categories

- Rolling budget support

Accelerated Debt Payoff

Take control of your debt with AI-optimized payoff strategies. Whether you prefer the avalanche or snowball method, we'll show you exactly how to become debt-free faster.

See how much interest you'll save and track your progress with motivating milestones along the way.

- Multiple payoff strategies

- Interest savings calculator

- Progress milestones

- Payoff date projections

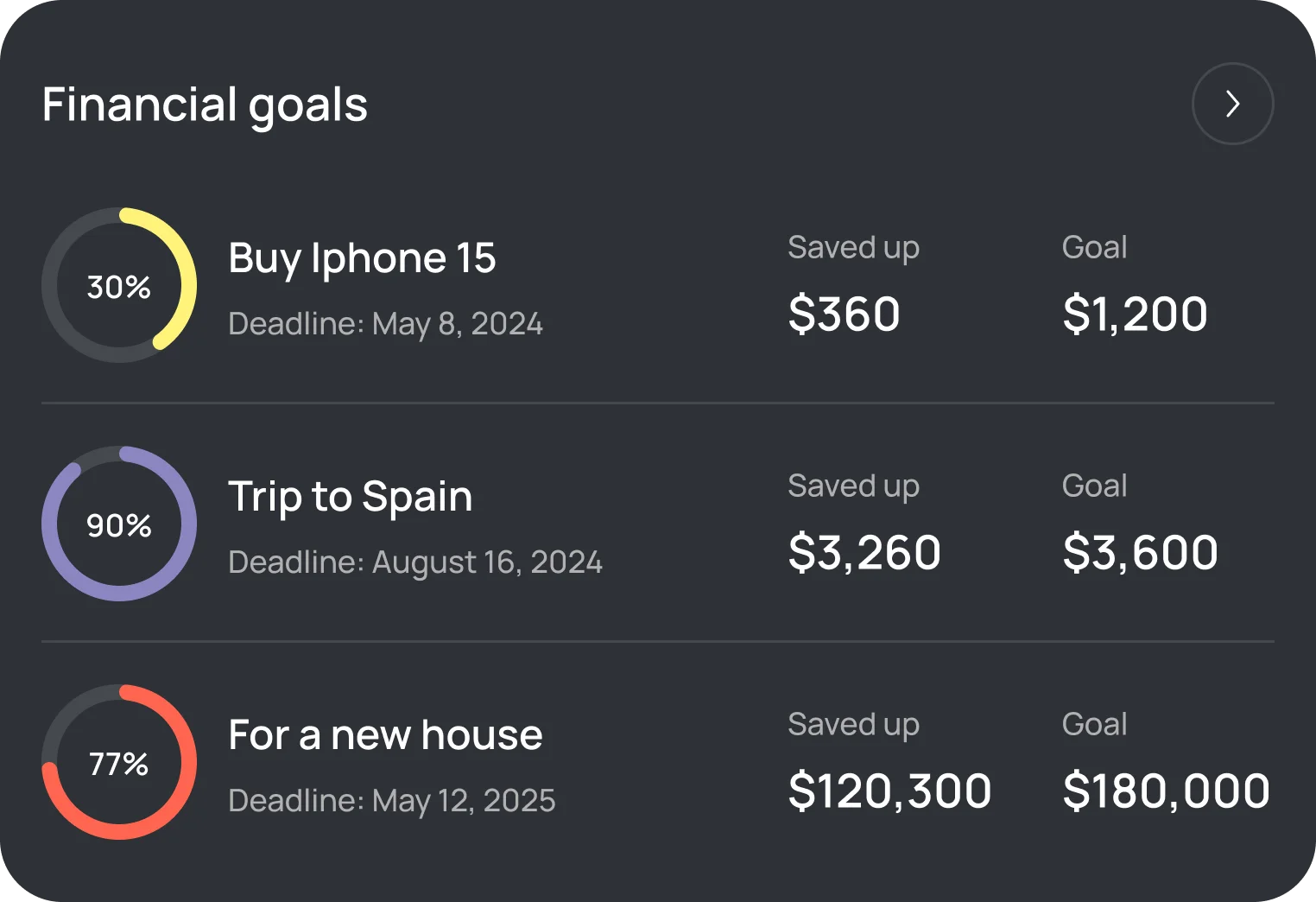

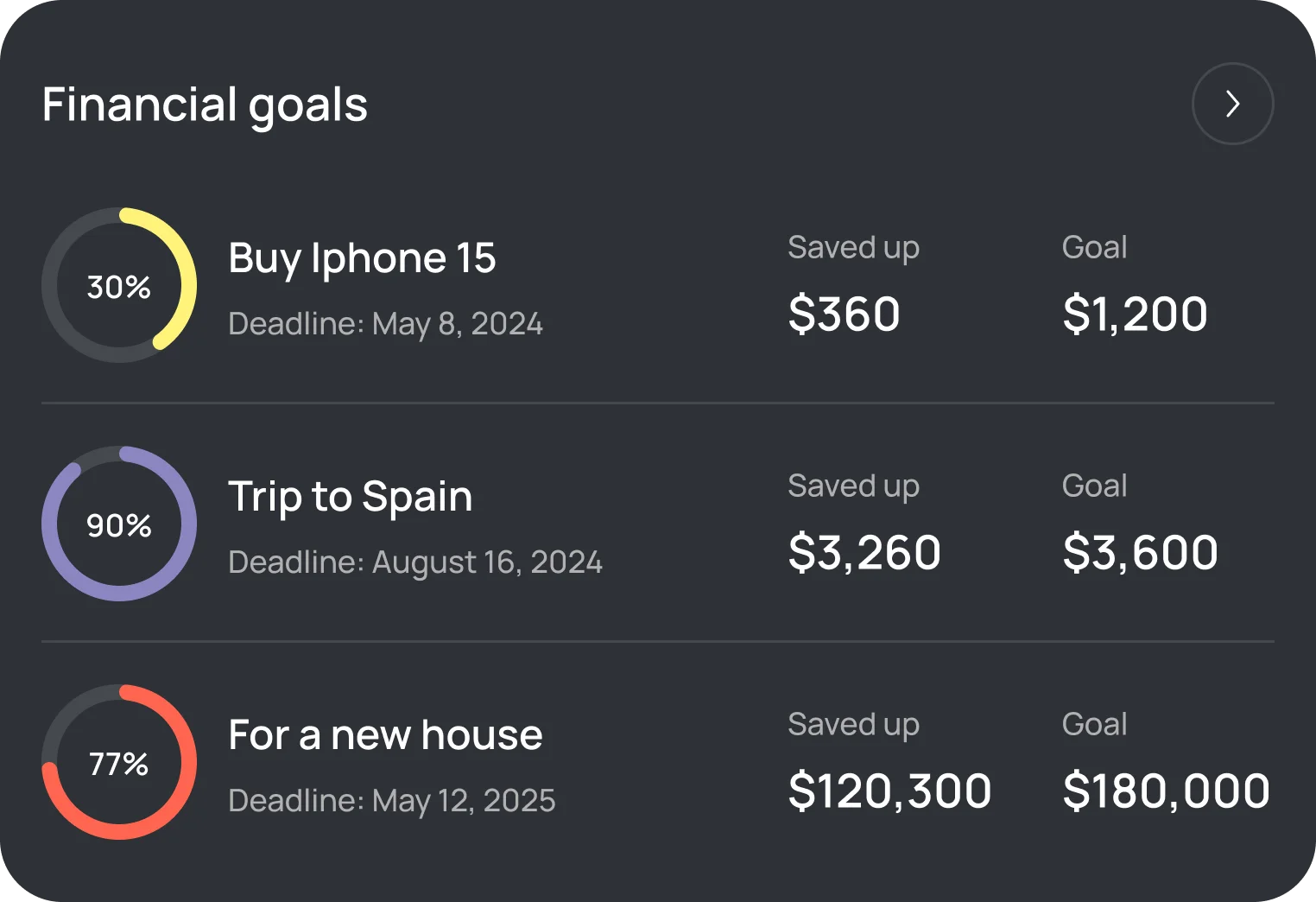

Visual Goal Tracking

Set financial goals and watch your progress in real-time. Whether saving for a vacation, emergency fund, or down payment, we help you stay motivated.

Automatic contributions and smart recommendations help you reach your goals faster than you thought possible.

- Unlimited savings goals

- Auto-contribution options

- Visual progress tracking

- Goal achievement rewards

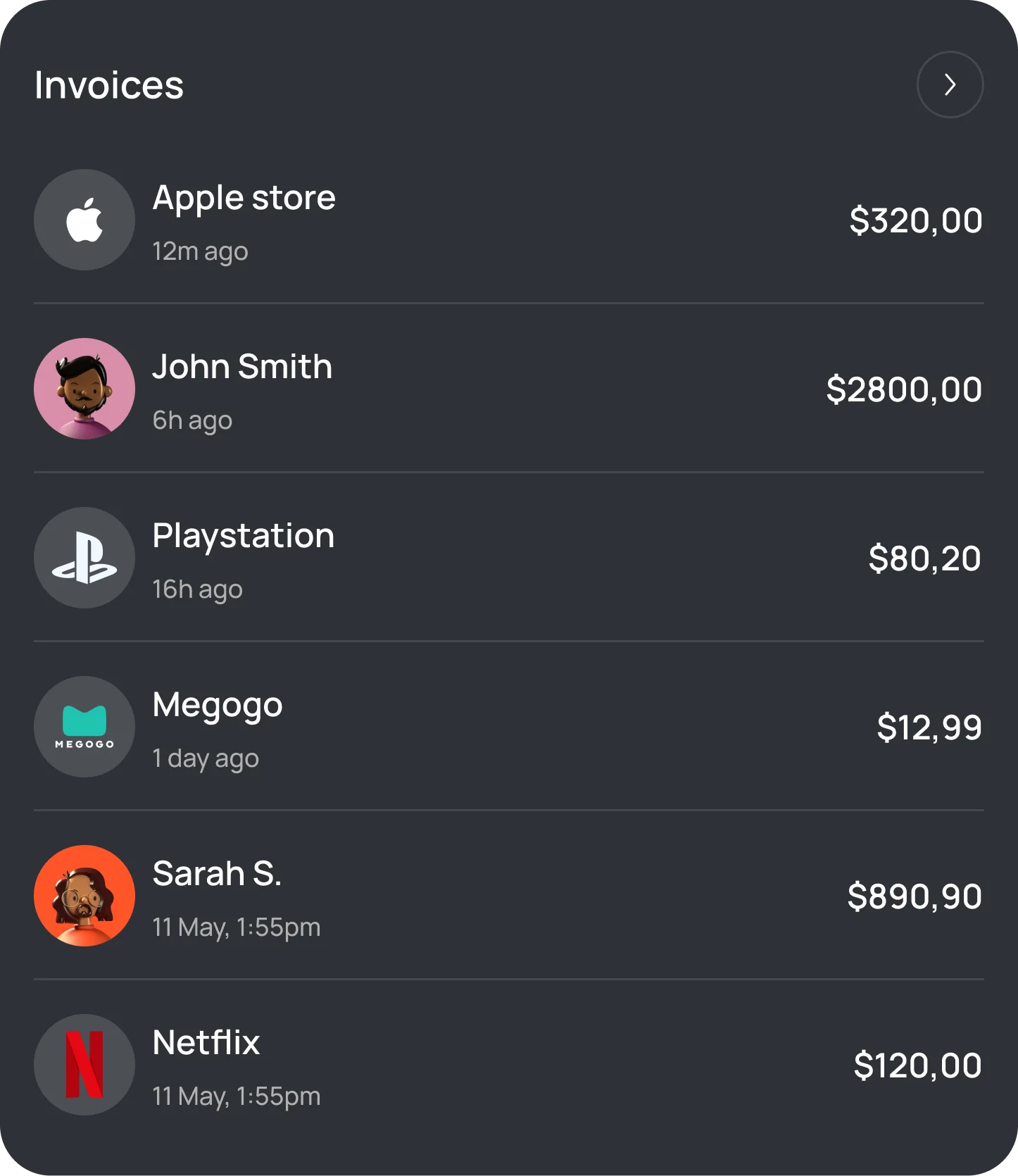

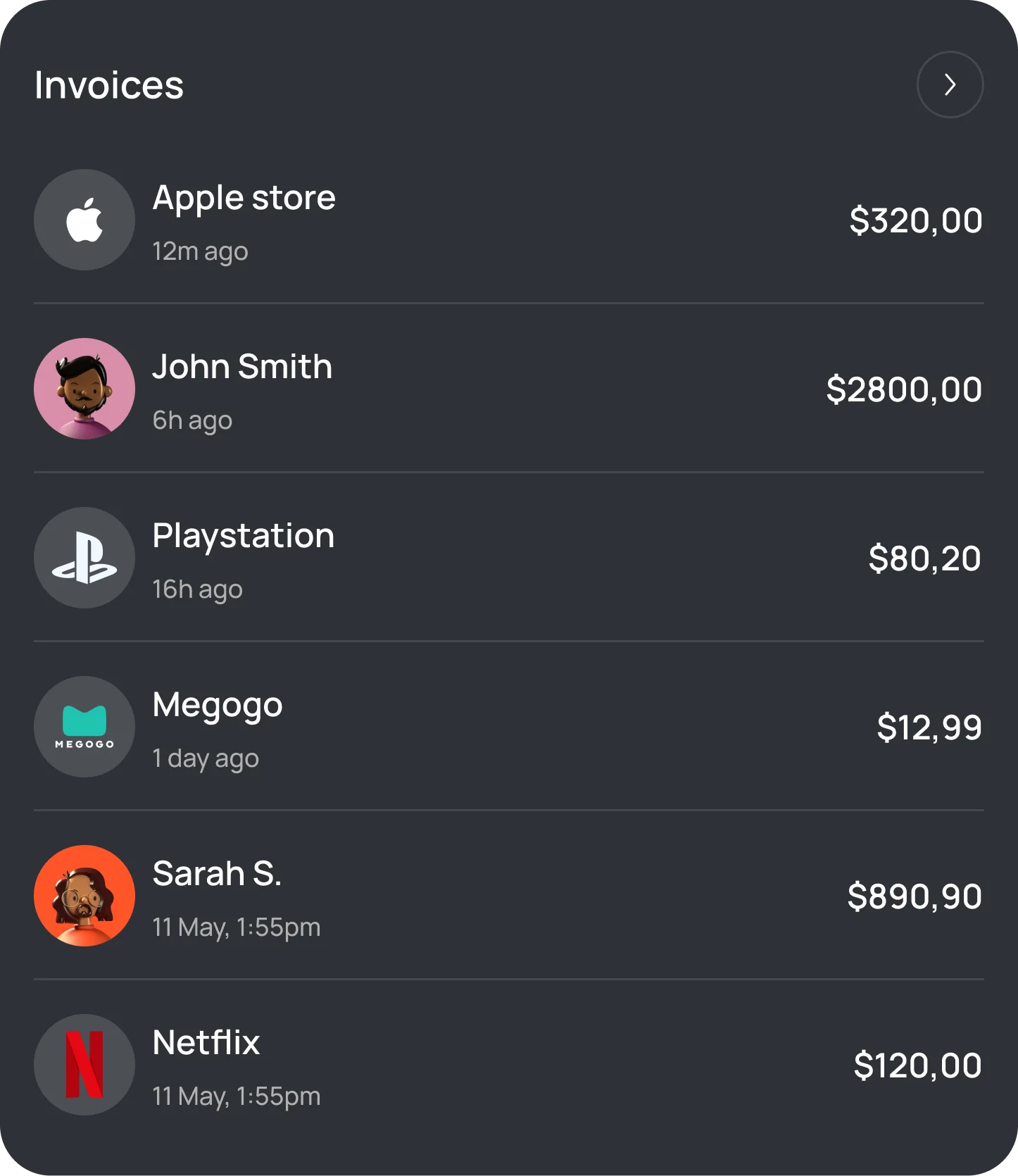

Never Miss a Payment

Track all your bills and subscriptions in one place. Get reminders before due dates and identify subscriptions you might have forgotten about.

Our smart calendar view shows your upcoming payments so you can plan ahead and avoid late fees.

- Bill due date reminders

- Subscription tracking

- Payment history log

- Late fee prevention alerts

Investment Portfolio Tracking

Monitor all your investments in one dashboard. Track stocks, ETFs, mutual funds, and retirement accounts with real-time performance data.

Get AI-powered insights on portfolio diversification and rebalancing opportunities to optimize your returns.

- Real-time portfolio tracking

- Performance analytics

- Diversification insights

- Retirement projections

Bank-Level Security

Your financial data is protected with the same security standards used by major banks. We use 256-bit encryption for all data transfers and storage.

With SOC 2 Type II and ISO 27001 certifications, you can trust that your information is safe. We never sell your data or share it with third parties.

- 256-bit AES encryption

- Multi-factor authentication

- Biometric login options

- SOC 2 Type II certified

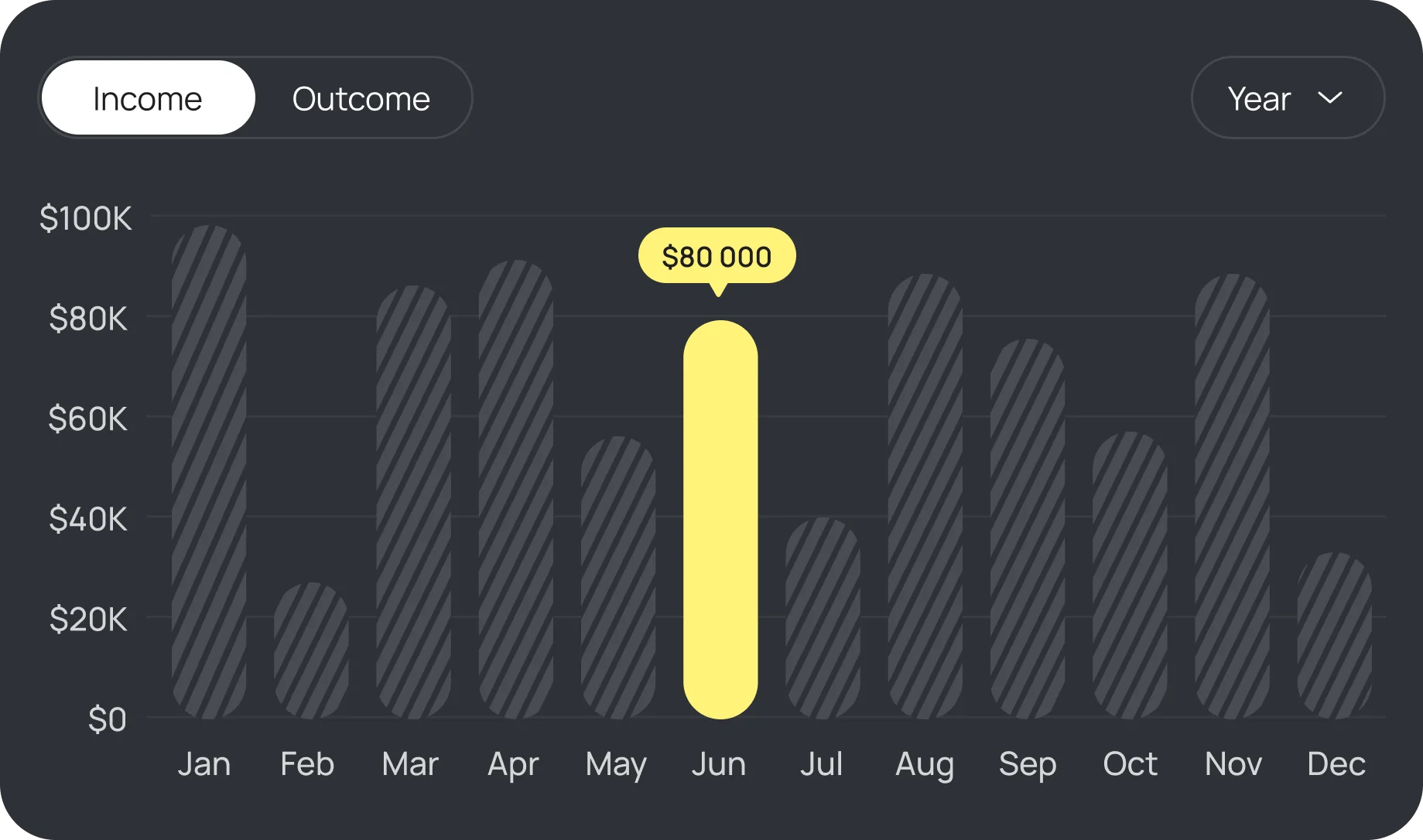

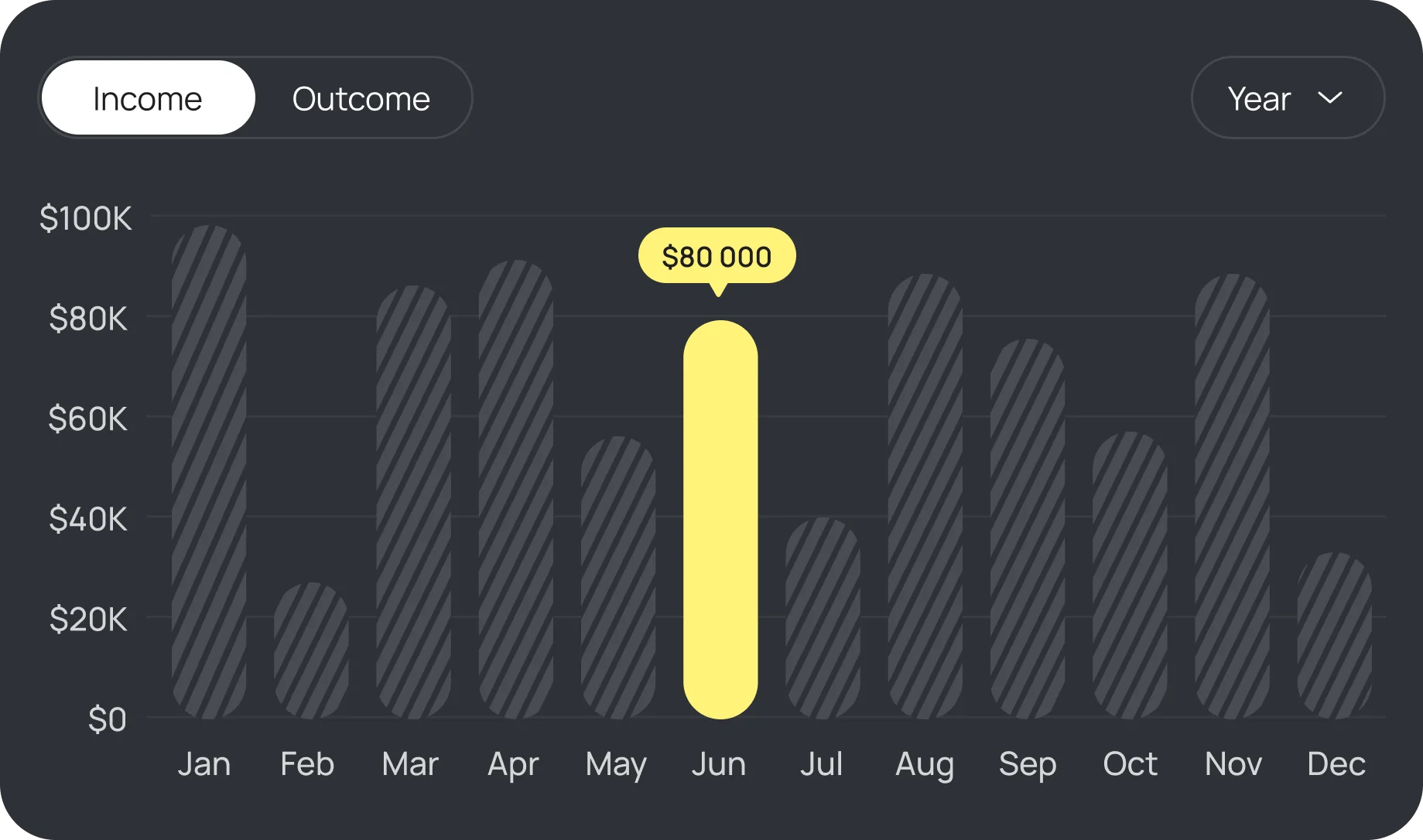

Detailed Financial Reports

Generate comprehensive reports that give you a clear picture of your financial health. Export to PDF or CSV for easy sharing with accountants or financial advisors.

Track your progress over time with visual breakdowns of income, expenses, and savings. Our reports automatically categorize transactions and highlight trends you might have missed.

- Monthly income vs expense breakdown

- Category-wise spending analysis

- Year-over-year comparison charts

- Export to PDF, CSV, or Excel

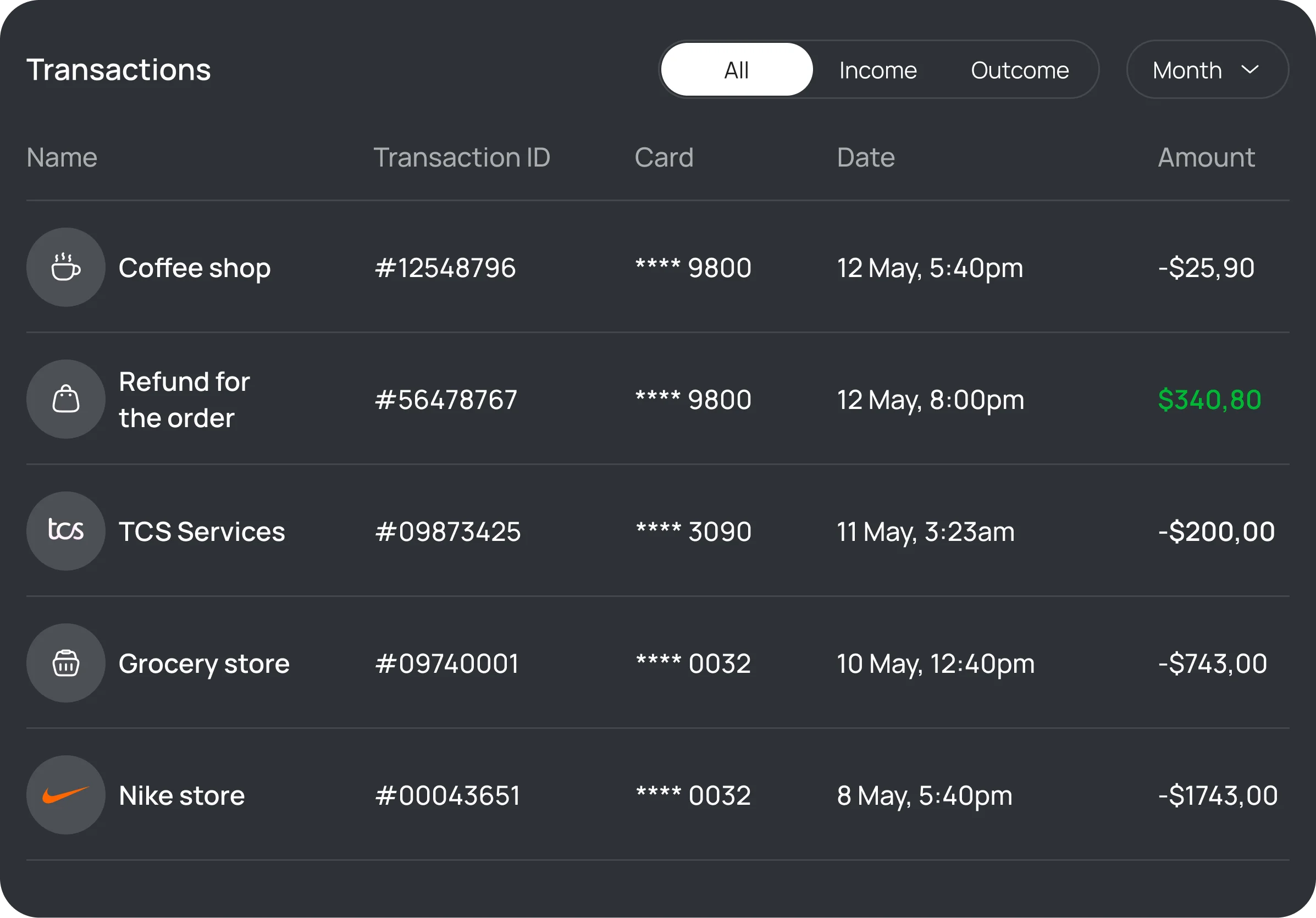

Effortless Expense Tracking

Every transaction is automatically categorized and tracked. No more manual entry or guessing where your money went.

Split transactions, add notes, and attach receipts to keep perfect records for tax time or expense reports.

- Automatic categorization

- Receipt attachment

- Transaction splitting

- Custom tags and notes

Automated Savings

Build your savings effortlessly with automated transfers and round-up features. Set rules to save spare change or a percentage of every deposit.

Watch your savings grow with our visual tools and celebrate milestones along the way to your financial goals.

- Automatic round-ups

- Scheduled transfers

- Savings rules engine

- Progress celebrations

Net Worth Dashboard

See your complete financial picture with our net worth tracker. All your assets and liabilities in one view, updated in real-time.

Track your wealth growth over time with beautiful charts and understand exactly what's driving changes in your net worth.

- Assets and liabilities tracking

- Historical net worth charts

- Growth trend analysis

- Wealth milestone tracking

Join thousands of happy customers

Take control of your finances today and see why thousands of users trust Cashflow to manage their money.

Cashflow helped me finally understand where my money was going. I've saved over $12,000 this year just by following the AI recommendations.

Sarah Chen

Small Business Owner

The debt payoff planner changed my life. I was able to pay off $45,000 in student loans two years ahead of schedule.

Marcus Johnson

Software Engineer

I love how all my accounts sync automatically. Having everything in one place makes budgeting so much easier.

Emily Rodriguez

Marketing Director

As a freelancer, my income varies a lot. Cashflow's smart budgeting adapts to my irregular paychecks perfectly.

David Park

Freelance Designer

The goal tracking feature kept me motivated. I saved for my dream vacation in just 8 months!

Rachel Thompson

Healthcare Professional

Finally, a finance app that's easy to use. The investment tracking gives me peace of mind about my retirement.

James Wilson

Retired Teacher

Connect with other savvy savers

Book a personalised demo with one of our experts to see how Budget Buddy can fit your unique financial needs.